Savings Account vs Checking Account: Best Guide

When it comes to personal finance, choosing the right type of bank account is one of the most important decisions you’ll make. Two of the most common account types are savings accounts and checking accounts. While both serve as secure places to store money, their purposes, features, and benefits differ significantly. Understanding the difference between savings accounts vs checking accounts can help you manage your money effectively, achieve your financial goals, and avoid unnecessary fees.

This comprehensive guide will explain the meaning, features, advantages, disadvantages, and key differences between savings accounts and checking accounts. We’ll also look at which option may suit different needs, provide comparison tables, and explore FAQs to ensure you have a complete understanding.

What is a Savings Account?

A savings account is a type of bank account designed primarily to help individuals save money over time. It usually earns interest, meaning the bank pays you a percentage of your balance for keeping your money with them.

Key Features of a Savings Account

- Interest Earnings: Banks typically offer annual percentage yields (APYs) on savings accounts, allowing your money to grow passively.

- Withdrawal Restrictions: Savings accounts usually limit the number of withdrawals per month (often 6).

- Safe Storage of Funds: Money is protected and insured by government agencies like the FDIC in the US (or equivalent in other countries).

- Lower Liquidity: Unlike checking accounts, savings accounts aren’t meant for everyday transactions.

- Minimum Balance Requirements: Some banks require you to maintain a minimum balance to avoid fees.

Advantages of a Savings Account

1. Foundation for Financial Resilience (The Emergency Fund): A savings account serves as the primary warehouse for your emergency fund. By maintaining a separate space for “rainy day” cash, you create a financial buffer that protects you from high-interest debt when unexpected life events occur—such as a sudden medical bill, urgent car repairs, or an unplanned period of unemployment.

2. The Power of Compound Interest: Unlike a standard checking account, a savings account rewards you for your deposits by paying interest. Over time, you benefit from compounding, where you earn interest not only on your initial principal but also on the accumulated interest from previous periods. This creates a “snowball effect” that allows your wealth to grow passively without any effort on your part.

3. Psychological Barriers to Overspending: The structure of a savings account encourages disciplined financial behavior. Because these accounts are not intended for daily transactions and often lack a direct-linked debit card for point-of-sale purchases, they create a “friction point.” This slight delay in accessing funds helps prevent impulsive spending and reinforces the habit of long-term wealth building.

4. Unmatched Capital Preservation and Security: Savings accounts are one of the safest places to store wealth. Funds held in a reputable bank are typically insured by the FDIC (or NCUA for credit unions) up to $250,000 per depositor. This means that even in the event of a total bank failure, your principal remains protected, offering a level of security that the stock market or cryptocurrency cannot match.

5. Seamless Liquidity and Integration: Modern banking allows you to link your savings account directly to your checking account for effortless transfers. This provides high liquidity, meaning that while your money is tucked away earning interest, it remains accessible within minutes or seconds through a mobile app if you need to move it back to your checking account to cover a large purchase.

Disadvantages of a Savings Account

1. Opportunity Cost and Lower Yields: The most significant drawback is the lower rate of return compared to riskier investment vehicles. While your money is safe, it will almost certainly earn less in a savings account than it would in a diversified portfolio of stocks, bonds, or real estate over a long-term horizon (5–10+ years). Utilizing a savings account for all your wealth can result in significant missed gains.

2. Transactional Friction and Limitations: Savings accounts are specifically not designed for daily commerce. They lack the convenience of unlimited check-writing or the ability to swipe a card at a grocery store. Furthermore, some institutions still maintain internal limits on the number of “convenient” withdrawals you can make per month, which can make them cumbersome if you need to access your cash frequently.

3. Erosion of Purchasing Power (Inflation Risk): Perhaps the “hidden” danger of a savings account is inflation. If your account earns 4% interest but the cost of living (inflation) rises by 5%, your “real” rate of return is actually negative. Over decades, keeping too much cash in a savings account can result in your money losing its purchasing power, meaning your balance stays the same but buys much less than it used to.

4. Maintenance Fees and Minimum Requirements: Many traditional banks impose monthly maintenance fees or require you to maintain a minimum daily balance to keep the account active. If you are not careful, these small fees can actually exceed the amount of interest you earn, effectively costing you money to store your cash. It is vital to seek out “no-fee” accounts to ensure your growth isn’t being eaten away by administrative costs.

What is a Checking Account?

A checking account is designed for frequent transactions like deposits, withdrawals, bill payments, and debit card purchases. It’s the primary account type most people use for everyday financial needs.

Key Features of a Checking Account

- Unlimited Transactions: You can write checks, make transfers, use ATMs, and spend via debit cards without restrictions.

- Low or No Interest: Most checking accounts do not pay interest, though some premium ones may.

- High Liquidity: Provides instant access to money.

- Bill Payment Functionality: Ideal for recurring expenses like rent, utilities, and subscriptions.

- Overdraft Options: Some accounts let you spend more than your balance (with fees).

Advantages of a Checking Account

- Easy access to funds anytime.

- Supports direct deposit for paychecks.

- Convenient for everyday purchases and payments.

- Offers digital tools like mobile banking, online transfers, and bill pay.

- Often comes with a debit card and checkbook.

Disadvantages of a Checking Account

- Usually earns little to no interest.

- Can involve overdraft and maintenance fees.

- Less effective for saving money.

- Risk of overspending due to easy access.

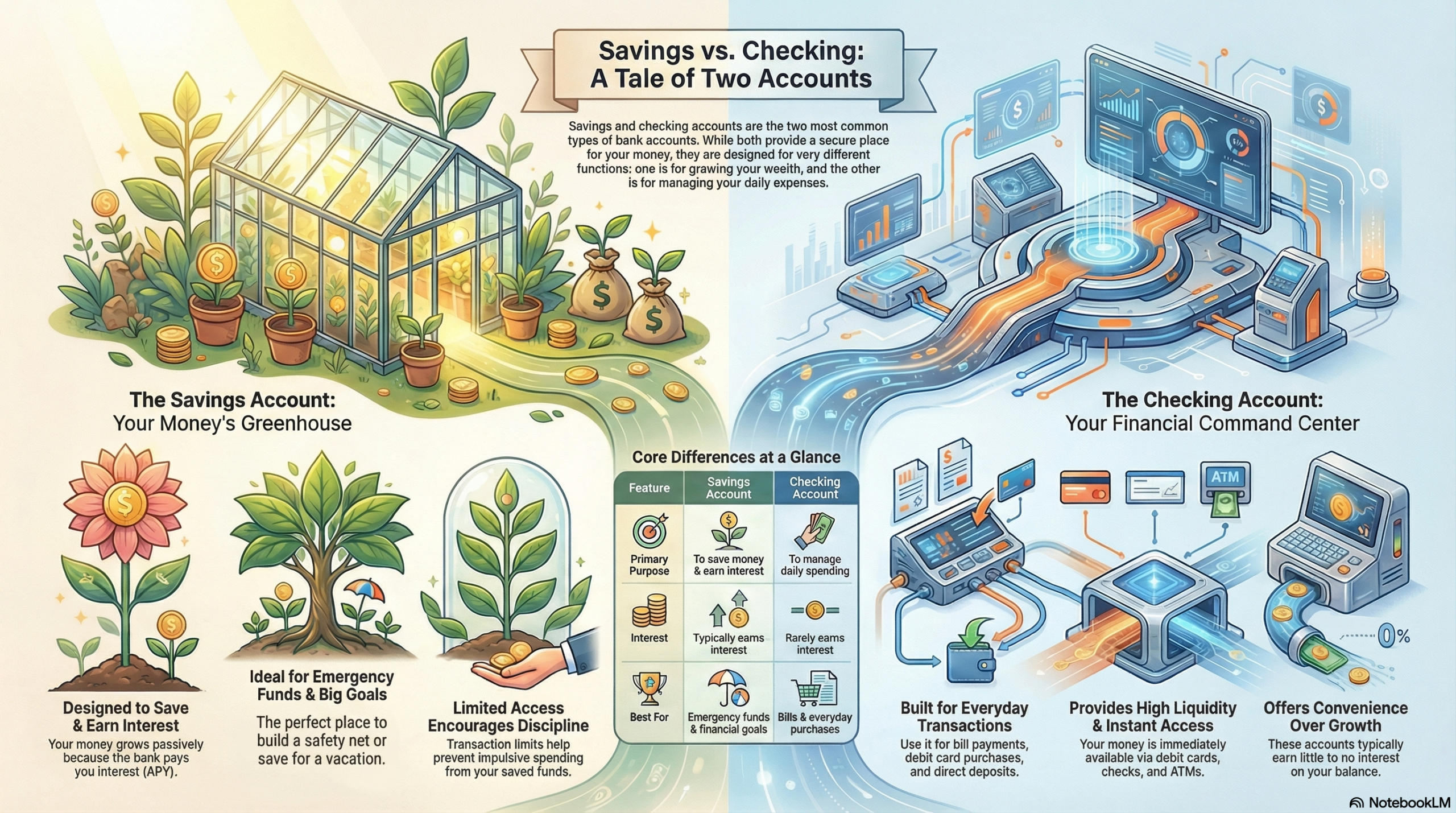

Savings Account vs Checking Account: Key Differences

Here’s a comparison table to highlight the main differences:

| Feature | Savings Account | Checking Account |

|---|---|---|

| Purpose | To save money and earn interest | To manage daily spending and transactions |

| Interest | Typically earns interest | Rarely earns interest (exceptions apply) |

| Access | Limited withdrawals, transfer restrictions | Unlimited transactions |

| Liquidity | Lower (not meant for daily use) | High (immediate access to funds) |

| Best For | Building savings, emergency funds, financial goals | Paying bills, everyday purchases, frequent transactions |

| Fees | May require minimum balance or incur fees | May charge overdraft, ATM, or maintenance fees |

| Debit Card/Checks | Often not provided | Provided for everyday use |

| Savings Growth | Encourages long-term growth with interest | No growth, mainly transactional |

When Should You Use a Savings Account?

A savings account is best suited for:

- Emergency Funds: Keeping 3–6 months worth of expenses in case of job loss or emergencies.

- Short-Term Goals: Saving for vacations, weddings, or big purchases.

- Financial Security: Protecting money in a safe, insured place.

- Supplementary Income: Earning small but steady interest.

When Should You Use a Checking Account?

A checking account is ideal for:

- Daily Transactions: Shopping, dining, or paying bills.

- Receiving Income: Direct deposits from employers.

- Cash Withdrawals: Accessing money through ATMs.

- Recurring Expenses: Mortgage, rent, utility payments, and subscriptions.

- Flexibility: Managing frequent transfers and payments.

Pros and Cons of Having Both Accounts

Pros

- Better money management.

- Savings remain untouched while spending needs are met.

- Financial flexibility with instant transfers.

- Improved budgeting and discipline.

Cons

- Possible extra maintenance fees.

- Requires monitoring multiple accounts.

Frequently Asked Questions (FAQs)

1: Can I use a savings account like a checking account?

Not really. Savings accounts limit transactions and aren’t designed for daily use.

2: Which account earns more interest?

Savings accounts almost always offer higher interest compared to checking accounts.

3: Do I need both accounts?

It depends on your financial habits. Having both provides balance between saving and spending.

4: Are these accounts safe?

Yes, funds are insured by regulatory bodies (like FDIC in the US).

5: Can I overdraft on a savings account?

No, overdraft protection generally applies to checking accounts only.

Conclusion

The difference between savings accounts vs checking accounts lies in their purpose: one is designed to grow your money safely with interest, while the other is built for convenience and frequent transactions. Neither is better than the other—both serve unique and complementary functions in personal finance. Ideally, you should have both accounts to maximize financial security, liquidity, and growth potential.

Whether you’re managing your first paycheck, planning an emergency fund, or just starting your financial journey, understanding these two account types is essential. By choosing wisely, you’ll be better equipped to save, spend, and achieve your financial goals effectively.