Money-Saving Tips That Actually Work for American Families

Managing household finances has become increasingly challenging for American families in recent years. With inflation continuing to impact everyday expenses and the cost of living reaching new heights in 2025, finding effective ways to save money isn’t just helpful—it’s essential. Whether you’re trying to build an emergency fund, pay down debt, or simply have more breathing room in your monthly budget, the right money-saving strategies can make a significant difference.

At GlobalFinMate, we understand the financial pressures families face. That’s why we’ve compiled these ten proven money-saving tips that actually work for real American households. These aren’t theoretical concepts or extreme frugality measures—they’re practical, sustainable strategies that can help you keep more money in your pocket without sacrificing your quality of life.

1. Master the Art of Strategic Credit Card Rewards

Credit cards often get a bad reputation, but when used responsibly, they can become powerful money-saving tools for your family. The key is understanding how to maximize cash back rewards and choosing the right cards for your spending patterns.

How to Make Credit Cards Work for You

Recent data shows that strategically using credit cards for everyday purchases can return significant cash back to cardholders. The secret lies in matching your spending habits with the right reward structures.

Consider this approach: Use a card that offers elevated rewards in categories where you spend the most. For example, if groceries represent a major household expense, select a card offering 3% to 6% cash back at supermarkets. For dining and entertainment, choose a card with bonus rewards in those categories. For everything else, maintain a flat-rate cash back card that earns at least 1.5% to 2% on all purchases.

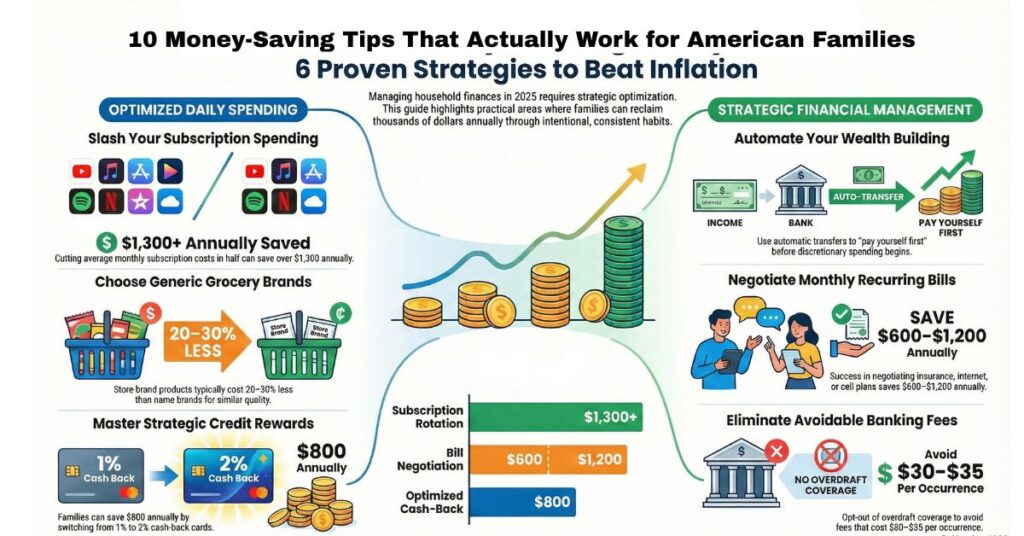

Pro tip from GlobalFinMate: Many families can save around $800 annually just by using a 2% cash back card instead of a 1% card for regular household spending. That’s money that could go toward your savings goals, vacation fund, or paying down debt.

Important Reminders

Always pay your balance in full each month to avoid interest charges that would negate any rewards earned. Credit card rewards only make financial sense when you’re not carrying a balance and paying interest fees.

2. Slash Your Subscription Spending

Subscription services have quietly become one of the biggest drains on American household budgets. The average American household now spends $219 monthly on subscriptions—that’s $133 more than most people realize they’re spending.

The Subscription Audit Strategy

Take an afternoon to review every recurring charge on your bank and credit card statements. You might be surprised to find subscriptions you forgot about or services you rarely use. Here are some actionable steps:

Cancel unused services: Be honest about which streaming platforms, apps, and memberships you actually use. If you haven’t logged into a service in the past month, it’s probably safe to cancel.

Try subscription rotation: Instead of maintaining multiple streaming services simultaneously, consider rotating between them. Watch everything you want on one platform for a couple months, then cancel and switch to another. This strategy can cut your entertainment costs in half while still giving you access to the content you love.

Leverage family plans: Many services offer family or group plans that cost only slightly more than individual subscriptions. Split costs with family members or trusted friends to reduce everyone’s expenses.

Embrace ad-supported tiers: Many streaming platforms now offer lower-cost options if you’re willing to watch advertisements, providing substantial value for minimal inconvenience.

The Financial Impact

If you’re currently spending the average of $219 per month on subscriptions and cut that in half through strategic cancellations and service rotation, you’ll save over $1,300 annually. That’s a significant amount that could boost your emergency fund or help tackle credit card debt.

3. Transform Your Grocery Shopping Habits

Food costs have skyrocketed in recent years, making grocery shopping one area where smart strategies can yield substantial savings. The good news is that reducing your grocery bill doesn’t mean eating poorly or spending hours clipping coupons.

Smart Shopping Strategies

Create a meal plan before shopping: Planning your weekly meals not only reduces food waste but also prevents impulse purchases. When you know exactly what you need, you’re less likely to buy items that will sit unused in your pantry.

Never shop hungry: Shopping when hungry is one of the easiest mistakes to make at the grocery store, often leading to impulse purchases of unnecessary items. Have a snack before heading to the store.

Shop early in the week: Stores are less crowded during the first few days of the week, which means less stress and fewer impulse decisions. Plus, you’ll find fully stocked shelves with the freshest options.

Choose generic brands: Store-brand products often come from the same manufacturers as name brands but cost 20-30% less. For most items, the quality difference is negligible while the price difference is substantial.

Embrace meal prep: Cooking in bulk and meal prepping saves money on groceries, reduces food waste, and makes weeknight dinners easier. Dedicate a few hours on Sunday to prepare meals for the week, and you’ll save both money and time.

Additional Grocery Savings

Use your credit card rewards strategically here. If you have a card offering cash back on groceries, make sure you’re using it for all supermarket purchases. Some cards offer up to 6% cash back at grocery stores, which can translate to hundreds of dollars saved annually for a typical family.

4. Automate Your Savings to Build Wealth Effortlessly

One of the most effective ways to ensure you’re saving money consistently is to remove the decision-making from the process entirely. When saving becomes automatic, you’re far more likely to stick with it.

Set Up Automatic Transfers

Setting up automatic transfers to your savings account each month makes saving effortless and ensures you pay yourself first. Even if you can only start with $25 or $50 per paycheck, automating the process means your savings will grow without requiring constant attention or willpower.

The “Pay Yourself First” Principle

This classic personal finance strategy means treating your savings contribution like any other essential bill. Before money goes toward discretionary spending, a portion automatically moves to savings. Over time, you’ll adjust your spending to your new “take-home” amount without missing the money that’s being saved.

Strategic Savings Approaches

Consider opening multiple savings accounts for different goals. Many banks allow you to create sub-accounts at no cost. You might have separate accounts for:

- Emergency fund (target: 3-6 months of expenses)

- Vacation savings

- Holiday gift fund

- Home improvement projects

- Children’s activities or education

Automating contributions to each account ensures steady progress toward multiple financial goals simultaneously.

5. Negotiate Your Monthly Bills Like a Pro

Many Americans don’t realize that most service providers are willing to negotiate rates to keep customers. A few phone calls can potentially save you hundreds of dollars annually.

Which Bills to Negotiate

Insurance premiums: Bundling insurance policies with the same company often results in significant discounts, especially for long-time customers. Call your insurance provider and ask about available discounts for bundling auto and home insurance, maintaining a good driving record, or installing security systems.

Internet and cable: These providers notoriously offer better deals to new customers than loyal ones. Call and mention you’re considering switching to a competitor. Often, customer retention departments can offer promotional rates that significantly reduce your monthly costs.

Cell phone plans: Wireless carriers regularly introduce new plans and promotions. Contact your provider to ensure you’re on the most cost-effective plan for your usage patterns.

Credit card interest rates: If you’re carrying a balance, call your credit card company and request a lower interest rate. If you have a good payment history, many issuers will reduce your rate to keep your business.

The Savings Potential

Even modest success in negotiating bills can save $50-100 monthly, which adds up to $600-1,200 annually. That’s money you could redirect toward paying off debt, building savings, or investing for your future.

6. Maximize Your Retirement Contributions for Free Money

If your employer offers a retirement plan with matching contributions, failing to take full advantage is literally leaving free money on the table.

Understanding Employer Matching

If your company matches your retirement contributions, even a modest monthly contribution can effectively double through employer matching. For example, if you contribute $100 monthly and your employer matches it, you’re actually saving $200 each month toward retirement.

The Compound Growth Effect

Beyond the immediate match, retirement contributions grow tax-deferred over time. Starting early and contributing consistently can result in substantial wealth accumulation. Individual contribution limits increased to $23,500 for 401(k) plans, with additional catch-up contributions available for those 50 and older.

Strategic Contribution Increases

If you’re not currently maximizing your employer match, increase your contribution percentage gradually. Try boosting your contribution by 1% whenever you receive a raise or bonus. You likely won’t notice the difference in your paycheck, but over time, these incremental increases can significantly impact your retirement savings.

7. Reduce Energy Costs with Smart Home Adjustments

Utility bills represent a significant monthly expense for most families, but simple changes can substantially reduce these costs without major investments.

Temperature Management

Every degree of extra air conditioning increases your energy usage by 6% to 8%, so setting your thermostat to the highest comfortable temperature can yield meaningful savings. In summer, aim for 78 degrees when home and higher when away. In winter, set it to 68 degrees or lower.

Simple Energy-Saving Upgrades

Window treatments: Insulated cellular shades and window blinds can help block sunlight that heats your home, reducing cooling costs.

LED bulbs: Replacing traditional bulbs with LED alternatives reduces electricity consumption and these bulbs last significantly longer, saving money on replacements.

Smart power strips: Many electronics draw power even when turned off. Smart power strips eliminate this “phantom” energy consumption.

Programmable thermostats: These allow you to automatically adjust temperature settings based on your schedule, ensuring you’re not heating or cooling an empty house.

Long-Term Considerations

While it represents a significant investment, upgrading to an efficient central air conditioning unit can reduce cooling costs by 20% to 40% compared to a 10-year-old unit. If your HVAC system is aging, the energy savings from a new unit can offset the purchase cost over time.

8. Eliminate Unnecessary Banking Fees

Banking fees might seem small individually, but they add up quickly and represent completely avoidable expenses.

Common Fees to Eliminate

Monthly maintenance fees: Many banks charge monthly account fees unless you maintain minimum balances or set up direct deposits. Shop around for banks and credit unions offering truly free checking accounts with no strings attached.

ATM fees: Using out-of-network ATMs can cost $3-5 per transaction. Plan ahead to use your bank’s ATMs, or choose a bank that reimburses ATM fees nationwide.

Overdraft fees: These can cost $30-35 per occurrence. Link your checking account to a savings account for overdraft protection, or opt out of overdraft coverage entirely to avoid these charges.

Paper statement fees: Many banks charge for mailed paper statements. Switch to electronic statements to avoid this fee and help the environment.

High-Yield Savings Accounts

Opening high-yield savings accounts or certificates of deposit allows you to earn significantly more on money already in the bank. While traditional savings accounts might offer 0.01% interest, high-yield accounts can offer rates 100 times higher, helping your emergency fund grow faster.

9. Embrace Strategic DIY Projects

Do-it-yourself projects represent an amazing way to save money on household tasks and repairs. While you shouldn’t attempt complex or dangerous projects, many common household tasks are simpler than you might think.

Smart DIY Opportunities

Home maintenance: Basic tasks like changing air filters, caulking bathrooms, painting rooms, and simple plumbing fixes can save hundreds in professional service fees. YouTube tutorials make learning these skills easier than ever.

Homemade cleaning products: Making your own cleaning solutions saves money and reduces exposure to harsh chemicals. Simple combinations of vinegar, baking soda, and dish soap can handle most household cleaning needs.

Basic car maintenance: Learn to change your own oil, replace air filters, and rotate tires. These simple tasks can save hundreds annually in service charges.

Meal preparation from scratch: Cooking from whole ingredients rather than buying pre-prepared foods can cut your grocery bill substantially while providing healthier meals.

Know Your Limits

Important note: Don’t risk your safety or your family’s wellbeing trying to save money on complex tasks like electrical work—some projects require professional expertise. The key is finding the balance between what you can safely learn and when to call in professionals.

10. Find Free or Low-Cost Family Entertainment

Creating amazing family memories doesn’t require breaking the bank on expensive entertainment. With creativity and planning, families can enjoy quality time together without the hefty price tag.

Budget-Friendly Entertainment Ideas

Explore like tourists: Many communities offer free activities like parks, gardens, and walking trails that provide hours of enjoyment for families. Check your local parks department, library, and community center websites for free or low-cost events.

Movie nights at home: Instead of spending $50-75 for a family movie theater trip, create a home theater experience. Pop popcorn, dim the lights, and stream a new release for a fraction of the cost.

Library resources: Modern libraries offer far more than books. Many provide free access to streaming services, museum passes, activity kits, and children’s programming.

Picnics and outdoor activities: Pack a lunch and spend the day at a local park, beach, or hiking trail. These outings cost only the price of the food you’d eat anyway.

Board game nights: Invest in a few quality board games and establish a weekly family game night tradition. The entertainment value per dollar spent is exceptional.

Community events: Most towns host free concerts, festivals, farmers markets, and outdoor movies during warmer months.

Making Entertainment More Affordable

When you do want paid entertainment experiences, look for discount opportunities. Many attractions offer discounted tickets through employer benefits programs, warehouse club memberships, or by purchasing gift cards at a discount through cash back shopping portals.

Implementing Your Money-Saving Strategy

The beauty of these money-saving tips is that you don’t need to implement them all at once. Start with the strategies that seem most manageable for your situation and gradually incorporate others.

Getting Started

Begin by selecting two or three tips that resonate most with your current financial situation. Maybe you’ll start by conducting a subscription audit, automating a small savings transfer, and maximizing credit card rewards on purchases you’re already making. Once these become habits, add one or two more strategies.

Tracking Your Progress

Keep track of the money you’re saving through these efforts. Seeing the concrete results can be incredibly motivating. Consider using a budgeting app or simple spreadsheet to monitor your progress toward financial goals.

The Compound Effect

Remember that small changes create significant results over time. By incorporating these strategies into your financial routine, you can make 2025 a year of significant savings and financial empowerment. Even saving an extra $200 monthly through these various strategies adds up to $2,400 annually—money that can transform your financial situation.

Conclusion

Saving money doesn’t require extreme sacrifices or an unrealistic frugal lifestyle. By making strategic choices about subscriptions, shopping habits, credit cards, and everyday spending, American families can significantly improve their financial position. The key is consistency and intentionality. Every dollar saved is a dollar that can work toward your family’s financial goals, whether that’s building an emergency fund, eliminating debt, saving for a dream vacation, or investing for your future.

At GlobalFinMate, we’re committed to helping families navigate their financial journey with practical advice and proven strategies. These ten money-saving tips have worked for countless American families, and they can work for yours too.

Remember, personal finance is exactly that—personal. Adapt these strategies to fit your unique situation, values, and goals. The best money-saving plan is one you’ll actually follow consistently. Start implementing one or two of these tips today, and watch your savings grow. Your future self will thank you for the financial discipline you establish now.