How to Get Business Financing: Best Guide

Starting or growing a business often requires capital that you might not have sitting in your bank account. Whether you’re launching your first startup or expanding an established company, understanding how to get business financing can make the difference between watching your dreams gather dust and actually bringing them to life.

At GlobalFinMate, we’ve seen countless entrepreneurs navigate the complex world of business financing options. Some sail through the process, while others struggle for months or even give up entirely. The difference? Knowledge, preparation, and strategy.

This comprehensive business financing guide will walk you through everything you need to know about securing business funding, from understanding your options to actually getting the capital you need to grow your business.

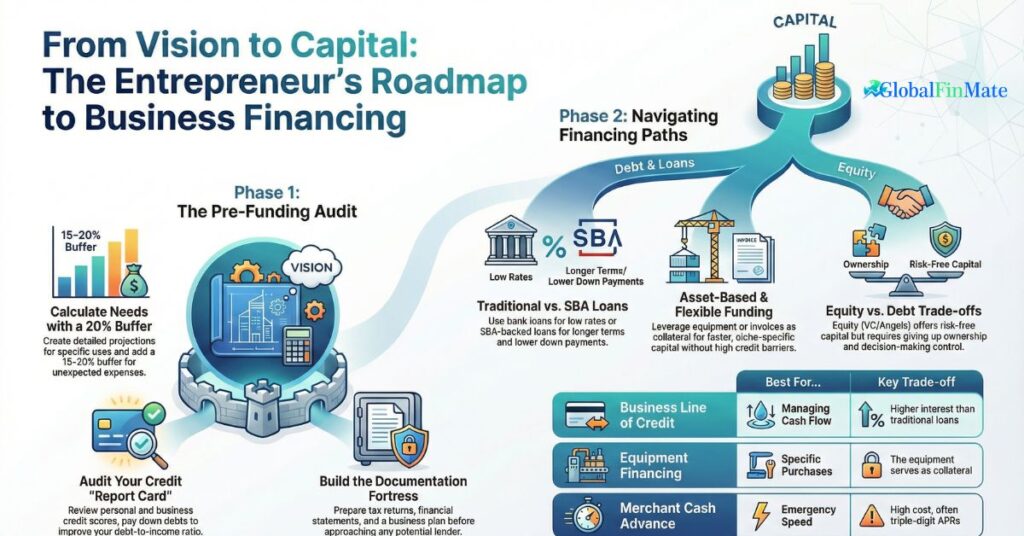

Understanding Your Financing Needs

Before you start approaching lenders or investors, you need to get crystal clear on why you need startup financing and how much you actually need. This might sound obvious, but you’d be surprised how many entrepreneurs skip this crucial step.

Start by creating a detailed financial projection for your business. What will you use the money for? Are you buying equipment, hiring staff, covering operational costs, or expanding to a new location? Each of these purposes might be better suited to different types of business loans.

Be realistic about the amount you need. Asking for too little means you might run out of funds before achieving your goals. Asking for too much can make lenders nervous and saddle you with unnecessary debt. A good rule of thumb is to calculate your actual needs, then add a buffer of about fifteen to twenty percent for unexpected expenses.

Consider your timeline as well. Do you need funds immediately, or can you wait several months? Some small business financing options move quickly, while others involve lengthy application and approval processes.

Know Your Financial Position

Lenders and investors will scrutinize your finances, so you should too. Before seeking business capital, take an honest look at where your business stands financially.

Pull together your financial statements including your balance sheet, income statement, and cash flow statement. If you’re a startup without historical data, create projections based on realistic market research and conservative estimates.

Check your business credit score and personal credit score. Your credit score acts like a financial report card, and lenders take it seriously. If your scores are lower than you’d like, consider taking a few months to improve your business credit before applying for financing. Pay down existing debts, correct any errors on your credit reports, and make all payments on time.

Calculate your debt-to-income ratio. This shows lenders how much of your income already goes toward debt payments. A lower ratio suggests you can comfortably take on additional debt.

Understanding these numbers not only prepares you for lender questions but also helps you identify which business financing options you’re most likely to qualify for.

Traditional Bank Loans: The Classic Route

Bank loans for small business remain one of the most common forms of business financing, and for good reason. They typically offer competitive business loan interest rates and substantial funding amounts. However, they’re also among the most difficult to obtain, especially for newer businesses.

Banks look for businesses with strong credit histories, solid financials, and often require collateral for business loans. They want to see that you’ve been in business for at least two years and that you’re profitable. If you meet these criteria, a traditional business loan could be your best option.

The business loan application process requires extensive documentation. Expect to provide business and personal tax returns, financial statements, a detailed business plan, and information about collateral. Banks may take weeks or even months to make a decision, so patience is essential.

One major advantage of bank loans is that you retain full ownership of your business. You’re simply borrowing money that you’ll repay with interest. Once the loan is paid off, you have no further obligations to the lender.

For guidance on preparing your application, check out our guide on how to apply for a business loan.

Small Business Administration (SBA) Loans

SBA loans are partially guaranteed by the Small Business Administration, which reduces the risk for lenders and makes them more willing to loan to small businesses. These government-backed business loans often feature longer repayment terms and lower down payments than conventional bank loans.

The most popular option is the SBA 7(a) loan, which can be used for almost any business purpose. These loans can go up to five million dollars, though most are considerably smaller. The SBA also offers microloans for small business of up to fifty thousand dollars, which are perfect for smaller financing needs.

The downside? SBA loan requirements involve even more paperwork than traditional bank loans and can take months to process. You’ll need to demonstrate that you’ve explored other financing options and explain why you need an SBA-backed loan specifically.

Despite the lengthy process, SBA loans are worth considering if you need substantial funding and can wait for approval. The favorable terms can save you thousands of dollars over the life of the loan.

Learn more about SBA loan programs and eligibility on our dedicated resource page.

Business Lines of Credit: Flexible Funding

A business line of credit works like a credit card for your business. You’re approved for a certain amount, and you can draw on it as needed. You only pay interest on the amount you actually use, making it a flexible option for managing business cash flow or handling unexpected expenses.

Lines of credit for small business are particularly useful for businesses with seasonal fluctuations or those that need to cover gaps between invoicing clients and receiving payment. They provide a safety net without the commitment of a traditional loan.

Qualifying for a small business credit line typically requires good credit and demonstrated revenue. Lenders want to see that your business generates consistent income and can repay what you borrow.

Interest rates on lines of credit tend to be higher than traditional loans, but the flexibility often makes up for the additional cost. You can use the funds, repay them, and use them again without reapplying.

Equipment Financing: Funding for Specific Purchases

If you need to purchase equipment, machinery, or vehicles for your business, equipment financing might be your answer. The equipment itself serves as collateral, which makes these equipment loans easier to obtain than unsecured financing.

Equipment financing options are structured so that you make regular payments over time, similar to a car loan. The lender retains a lien on the equipment until you’ve paid off the loan in full. If you default, they can repossess the equipment.

This type of financing makes sense when you need expensive equipment to operate or grow your business but don’t have the capital to purchase it outright. Rather than depleting your cash reserves, you spread the cost over time while using the equipment to generate revenue.

One consideration is that equipment depreciates over time. Make sure the loan term doesn’t extend beyond the useful life of the equipment, or you could end up paying for equipment that’s already obsolete.

Invoice Financing: Turning Receivables into Cash

If your business invoices clients with payment terms of thirty, sixty, or ninety days, invoice financing can help bridge the cash flow gap. This type of financing allows you to borrow against your outstanding invoices, receiving a percentage of their value immediately.

There are two main types of invoice factoring and financing. Invoice factoring involves selling your invoices to a factoring company at a discount. They collect payment directly from your customers. Invoice financing, on the other hand, uses your invoices as collateral for a loan, and you remain responsible for collecting payment.

This option works well for B2B companies with creditworthy customers but can be expensive. Fees typically range from one to five percent of the invoice value, which can add up quickly.

The major benefit is speed. You can often access funds within days, making accounts receivable financing ideal for managing cash flow crunches without taking on long-term debt.

Merchant Cash Advances: Fast but Costly

A merchant cash advance (MCA) provides a lump sum of cash in exchange for a percentage of your future credit card sales. Repayment happens automatically as you process transactions, with the lender taking their percentage daily or weekly.

The main appeal is accessibility and speed. Businesses with strong credit card sales can often qualify even with less-than-perfect credit, and funding can happen within days.

However, merchant cash advances are among the most expensive alternative business financing options available. The factor rates (not interest rates) can translate to annual percentage rates well into triple digits. They should be considered a last resort or used only when you’re confident that the immediate access to capital will generate returns that justify the high cost.

For safer alternatives, explore our guide on affordable business financing options.

Angel Investors and Venture Capital: Equity Financing

Not all financing involves debt. Equity financing means selling a stake in your company to investors in exchange for capital. Angel investors are typically wealthy individuals who invest their own money in early-stage companies. Venture capitalists manage funds from institutions and high-net-worth individuals.

The advantage of startup funding from investors is that you don’t have to repay the money if your business fails. Investors take on the risk in exchange for potential high returns if your company succeeds.

The tradeoff is that you give up ownership and control. Investors will want a say in how you run your business, and you’ll be accountable to them for major decisions. You’re also sharing future profits with them.

This route makes sense for high-growth startup financing in scalable industries like technology or healthcare. If you’re building a local service business, equity financing probably isn’t the right fit.

Want to learn more about attracting investors? Read our article on how to pitch to angel investors and VCs.

Crowdfunding: The Power of Many

Crowdfunding for business platforms allow you to raise small amounts of money from many people. Reward-based crowdfunding (like Kickstarter) gives backers a product or perk in exchange for their contribution. Equity crowdfunding allows investors to purchase shares in your company through platforms like SeedInvest.

Successful crowdfunding campaigns require more than just setting up a campaign page. You need a compelling story, an engaged audience, and a solid marketing plan. The most successful campaigns spend months building buzz before launching.

The upside is that crowdfunding validates your business idea. If people are willing to put money behind it, you’ve proven there’s market demand. You also gain customers and advocates who are invested in your success.

The challenge is that failed campaigns are public, and running a successful campaign requires significant time and effort. You’ll need great visuals, regular updates, and active promotion across social media.

Grants: Free Money (If You Qualify)

Business grants provide funding that you don’t have to repay, making them incredibly attractive. Government agencies, corporations, and nonprofits offer small business grants for businesses that meet specific criteria.

The catch is that grants for entrepreneurs are highly competitive and often come with strings attached. You might need to be in a particular industry, demographic group, or geographic location. Grant applications can be time-consuming, and the approval process is lengthy.

Despite these challenges, government grants for small business are worth pursuing if you qualify. Start with the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs if you’re in research or technology. Many states and cities also offer local business grants to encourage economic development.

Don’t rely solely on grants for your financing needs, but definitely explore them as a supplement to other funding sources. Check out Grants.gov for federal grant opportunities.

Bootstrapping: Self-Funding Your Business

Bootstrapping a business means funding your business through personal savings, revenue from operations, or money from friends and family. While it won’t work for every business, self-funding offers complete control and freedom from debt.

Many successful companies started this way. By keeping costs low and reinvesting profits, you can grow sustainably without taking on outside capital. This approach forces you to be creative and efficient, skills that serve you well even after you’ve secured other financing.

The downside is slower growth. Without external funding, you’re limited by how much cash you can personally inject and how quickly your business generates revenue. In competitive markets, this might allow better-funded competitors to outpace you.

Consider starting with bootstrapping and seeking external business funding only when you’ve proven your business model and need capital to scale.

Preparing Your Application: Making Your Case

Regardless of which financing option you pursue, preparation is key. Lenders and investors want to see that you’ve thought through your business thoroughly and have a clear plan for success.

Start with a solid business plan for financing that outlines your business model, target market, competitive landscape, marketing strategy, and financial projections. Your plan should tell a compelling story about why your business will succeed.

Prepare a detailed breakdown of how to use business loan funds. Vague requests for working capital won’t inspire confidence. Instead, show exactly what you’ll purchase or invest in and how each expense contributes to growth or profitability.

Gather all necessary business loan documentation before you apply. This typically includes tax returns, financial statements, bank statements, legal documents, and any licenses or permits. Having everything ready shows that you’re organized and professional.

Practice your pitch. Whether you’re sitting across from a loan officer or presenting to investors, you need to articulate your vision clearly and answer questions confidently. Role-play with a trusted advisor to identify weak points in your presentation.

Download our free business loan application checklist to ensure you have everything you need.

Building Relationships with Lenders

Getting financing isn’t just about numbers; it’s also about relationships. Start building connections with business lenders and investors before you need money. Attend networking events, join business organizations, and get to know people at local banks and credit unions.

When you do need small business funding, these relationships can make a significant difference. A loan officer who knows you and your business is more likely to advocate for your application. An investor who’s followed your progress will have more confidence in your ability to execute.

Keep these relationships alive even after you’ve secured financing. Stay in touch, provide updates on your business, and be transparent about challenges and successes. This builds trust and makes future business financing easier to obtain.

Understanding Terms and Conditions

Before accepting any financing offer, make sure you understand exactly what you’re agreeing to. Read all business loan terms and conditions carefully, and don’t hesitate to ask questions or consult with an attorney or accountant.

Key terms to pay attention to include the interest rate, repayment schedule, fees, prepayment penalties, and what happens if you miss a payment. For equity financing, understand the business valuation, how much ownership you’re giving up, and what rights investors will have.

Calculate the total cost of financing, not just the monthly payment. A loan with a lower monthly payment but a longer term might actually cost you more over time. Run the numbers and make sure the financing makes financial sense for your business.

Watch out for red flags like extremely high fees, vague terms, or pressure to sign quickly without time to review. Legitimate lenders want you to succeed and will give you time to make an informed decision.

Use our business loan calculator to compare different financing options and understand your total costs.

Common Mistakes to Avoid When Seeking Business Financing

Many entrepreneurs make avoidable mistakes that can derail their business financing journey. Here are the most common pitfalls to watch out for:

Applying before you’re ready – Submitting an incomplete or poorly prepared application wastes everyone’s time and can hurt your chances of approval. Take the time to gather all documents and create a compelling case.

Not shopping around – The first lender you talk to might not offer the best terms. Compare multiple business loan offers to ensure you’re getting competitive rates and favorable terms.

Ignoring your credit score – Your business credit rating significantly impacts your financing options. Don’t wait until you need money to discover you have credit issues.

Borrowing too much or too little – Overestimating your needs saddles you with unnecessary debt. Underestimating leaves you scrambling for additional funding later.

Choosing the wrong type of financing – A merchant cash advance might provide quick cash, but if you could qualify for a traditional loan with better terms, you’re paying unnecessarily high costs.

For more insights, read our article on top mistakes entrepreneurs make with business loans.

Alternative Financing Options for Bad Credit

If you have bad credit business financing needs, don’t lose hope. While traditional lenders may be out of reach, several alternatives exist:

Peer-to-peer lending platforms like Funding Circle connect borrowers with individual investors willing to take on more risk for potentially higher returns.

Community Development Financial Institutions (CDFIs) focus on serving underserved markets and may have more flexible lending requirements for bad credit.

Microloans through organizations like Kiva or local nonprofit lenders offer smaller amounts with less stringent credit requirements.

Asset-based financing like equipment loans or invoice financing focuses more on the value of your assets than your credit score.

The key is being transparent about your credit challenges and demonstrating how you’re addressing them while showing the strength of your business model.

Moving Forward with Confidence

Securing business financing can feel overwhelming, but remember that millions of entrepreneurs have successfully navigated this process before you. At GlobalFinMate, we believe that with the right knowledge and preparation, you can find the financing that fits your business needs.

Start by getting clear on your financing needs and understanding your current financial position. Research your business funding options thoroughly and choose the ones that align with your business goals and circumstances. Prepare your application materials carefully and build relationships with potential lenders or investors.

Most importantly, don’t give up if you face rejection. Many successful businesses were turned down multiple times before finding the right financing partner. Each no brings you closer to a yes, and each conversation helps you refine your approach.

Your business idea deserves the chance to succeed. With persistence, preparation, and the right financing strategy, you can secure the capital you need to turn your entrepreneurial dreams into reality. The road ahead may have challenges, but with this roadmap in hand, you’re well-equipped to navigate the journey to business financing success.

Conclusion: Get Business Financing

Securing the right business financing is one of the most important steps in turning your entrepreneurial vision into reality. Whether you’re launching a new startup, expanding operations, or navigating temporary cash flow challenges, understanding how funding works empowers you to make smarter financial decisions. From traditional bank loans and SBA-backed programs to modern alternatives like crowdfunding, invoice financing, and venture capital, today’s entrepreneurs have more options than ever before.

The key is preparation—knowing your financial position, choosing the right type of financing, and presenting a strong, well-researched application. Take time to build relationships with lenders, monitor your creditworthiness, and continuously strengthen your business model. If one funding option doesn’t work out, explore another. Persistence often makes the biggest difference.

At GlobalFinMate, we believe that every entrepreneur deserves access to the knowledge and tools needed to grow their business with confidence. With the right strategy and financial plan, you can secure the capital needed to scale sustainably and achieve long-term success. Your business journey may be challenging, but with informed decisions and the right financing partner, your goals are well within reach.