Checking vs Savings Accounts: The Difference Explained

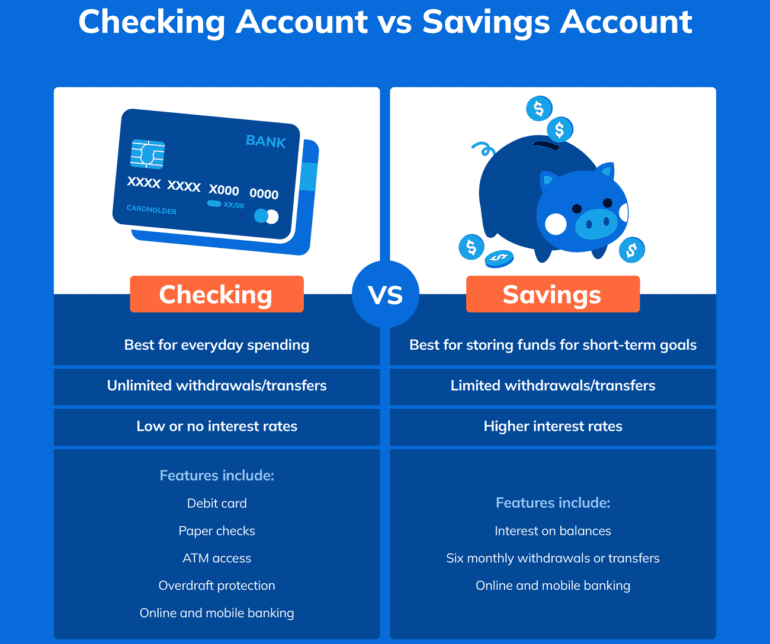

Checking and savings accounts share a host of similarities. They’re both relatively accessible to the average person, and both are convenient places to store your cash. But a checking account is better for certain tasks than a savings account, and vice versa. Understanding these nuances can help you manage your money wisely.

Key Takeaways

- Checking accounts are designed for everyday spending and deposits.

- Checking accounts offer easy access to your money with a debit card, checks, and simple account-to-account transfers, with few transaction-related limitations.

- Checking accounts sometimes earn interest, though rates are usually very low; still, high-interest checking accounts do exist.

- Savings accounts are designed for keeping money rather than spending it, and they may have stricter withdrawal limits and other constraints, depending on the institution.

- Savings accounts usually earn higher interest rates than checking accounts.

Checking vs. Savings Accounts

What Are the Main Differences Between Checking and Savings Accounts?

Not sure which account type best suits your needs? Here’s how checking and savings accounts compare.

| Feature | Checking Account | Savings Account |

|---|---|---|

| Function | Enable everyday transactions, including daily spending, bill payments, etc. | Hold money for longer-term financial goals, emergencies, etc. |

| Access | Relatively easy access to cash via debit card and ATMs. Can be easily connected to online accounts (utility accounts, money-sharing apps). Few transaction limitations. | Money can be harder to access (no checks, may not come with a debit card, etc.). Some banks impose monthly withdrawal limits. Can’t always be connected to online accounts. |

| Interest | Uncommon, and usually at lower rates than savings accounts. | Common, and often at higher rates than interest-earning checking accounts. |

| Balance Requirements | Varies by product and bank, but may be required to waive monthly fees. | Varies by product and bank, but may be required to waive monthly fees or earn interest. |

| Fees | May charge ATM fees, monthly maintenance fees, and overdraft fees (fees vary by institution and account). | May charge monthly maintenance fees, excess withdrawal fees (fees vary by institution and account). |

Checking Accounts

Checking accounts are made for everyday spending, so easy access is the name of the game. Debit cards let you pay for products and services and withdraw cash from ATMs, while relaxed (or nonexistent) transaction limits make it easy to pay monthly bills and other recurring or frequent expenses.

One downside is that checking accounts rarely accrue interest the way savings accounts do. When they do, rates are often on the lower end, and the account may come with more fees than a standard checking account. However, some high-yield checking accounts offer rates competitive with high-yield savings accounts, though requirements to earn the best rate can be somewhat strict, like having a certain amount in deposits per month.

Savings Accounts

Savings accounts usually serve as a place to store money that you won’t need to use immediately. These accounts often come with rules and limits that can make it slightly tougher to access your money than it might be with a checking account, but usually, you can transfer money to your checking as needed.

A savings account may not come with a debit card, and your bank may limit the number of monthly withdrawals you can make, possibly charging a fee if you exceed a certain number. You may not be able to use a savings account for online bill payment or with peer-to-peer transfer services, though rules vary by bank.

To offset these limitations, savings accounts often offer a higher interest rate than you’d get with most checking accounts. In some cases, rates provided by high-yield savings accounts can even compete with those offered by other savings products.

Withdrawal Limits on Checking and Savings Accounts

Both checking and savings accounts come with their own rules governing withdrawals, and those rules are fairly different.

Checking Account Withdrawal Limits

Checking accounts are typically extremely flexible in terms of withdrawal limits. In general, most people can spend and transfer as much as they need to.

You may run into some limitations here and there. ATM withdrawals are generally capped at a certain dollar amount per transaction and per day, with potentially other weekly and monthly caps. Debit cards sometimes have daily purchase limits, too. But these limits depend on the institution and the account—many banks offer various types of checking accounts, some more restrictive than others.

Savings Account Withdrawal Limits

For many years, withdrawals from savings accounts were federally capped at six per month. Though this regulation was eliminated in March 2020, granting savings accounts more flexibility, many banks still impose their own similar withdrawal limits. These limits can vary between financial institutions. Check the terms and conditions of any account you’re planning to open to make sure you understand the rules and limitations.

Checking vs. Savings Accounts: Which Is Better?

Whether you’d benefit more from a checking or savings account depends entirely on what you’re planning to do with your money.

- For frequent spending or receiving money, a checking account is likely the best choice due to its flexibility and transaction-oriented design.

- For storing extra cash and earning interest, a savings account is a great option (though other savings vehicles may also be worth considering).

Often, the answer is that it makes sense to have at least one of each account. You may want to open one of each at the same bank for quick and easy transfers between accounts, but having accounts at separate banks isn’t a problem as long as you stay organized.