Bank of Canada Interest Rate Explained

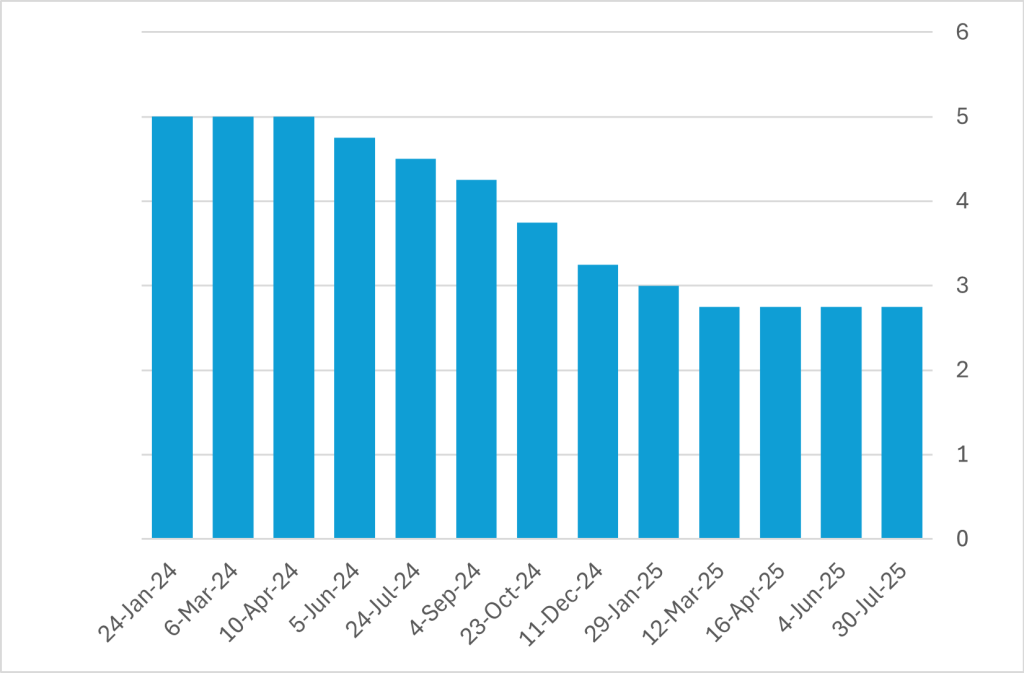

On July 30, 2025, the Bank of Canada announced that it is holding its policy rate at 2.75%.

Whether you’re looking to purchase a home, renew your existing mortgage or want to add a unit to your property, an RBC Mortgage Specialist can advise you on the right mortgage solution for your situation.

How Rates Have Changed Over the Last Year

The Bank of Canada’s policy rate, also known as the overnight rate, plays a critical role in shaping the financial landscape of the country. It directly influences borrowing costs, including mortgage rates, and can have a significant impact on homeowners and prospective buyers. Understanding how changes in the policy rate affect your mortgage is essential for managing your finances effectively.

What is the Bank of Canada Policy Rate?

The policy rate is the interest rate at which major financial institutions borrow and lend money to each other overnight. The Bank of Canada adjusts this rate to achieve its monetary policy goals, such as controlling inflation, stabilizing the economy, and fostering employment growth. When the policy rate changes, it sets off a chain reaction that affects various interest rates across the economy, including those tied to mortgages.

Impact on Variable-Rate Mortgages

If you have a variable-rate mortgage, changes in the Bank of Canada’s policy rate could directly affect your mortgage payments. Variable-rate mortgages are tied to a lender’s prime rate, which typically moves in tandem with the policy rate. It is important that you speak with your Mortgage Specialist to understand the type of mortgage you have and what triggers could be activated by a rate change as these vary by lender.

- Rate Increase: When the Bank of Canada raises the policy rate, your lender’s prime rate will likely increase as well. This means your mortgage interest rate will rise and depending on the type of variable rate mortgage you could either have:

- the same monthly payment. This occurs in most cases with RBC, so can be sure how much your payment will be each month. However, you’d be repaying less towards the principle therefore extending the time it’ll take to pay off your mortgage.

- higher monthly payments – that you would need to plan for.

- Rate Decrease: Conversely, if the Bank of Canada lowers the policy rate, your lender’s prime rate will likely decrease. With RBC, your mortgage payment will remain the same, but a reduction in your mortgage interest rate would mean that more of your payment is being allocated to paying off the principle and could reduce the time it takes to pay off your mortgage.

Impact on Fixed-Rate Mortgages

For fixed-rate mortgages, the effect of changes in the policy rate is less immediate but still significant. Fixed-rate mortgages are influenced by bond yields, which are indirectly affected by the policy rate.

- Rate Increase: When the policy rate rises, bond yields often increase as well, leading to higher fixed mortgage rates. This means that if you’re renewing your mortgage or applying for a new one, you could face higher interest rates, resulting in larger monthly payments.

- Rate Decrease: A lower policy rate can lead to lower bond yields, which may reduce fixed mortgage rates. This could make fixed-rate mortgages more affordable for new buyers or those renewing their loans.

Broader Implications

Changes in the policy rate can also affect housing affordability and the overall real estate market. Higher rates can cool down housing demand, as borrowing becomes more expensive, potentially leading to slower price growth or even price declines. On the other hand, lower rates can stimulate demand, driving up home prices.

How to Prepare for Rate Changes

- Budget for flexibility: If you have a variable-rate mortgage, ensure your budget can accommodate potential rate increases.

- Consider fixed vs. variable: Evaluate whether a fixed-rate mortgage might provide more stability in a rising rate environment.

- Stress-test your finances: Use a higher hypothetical interest rate to assess whether you can still afford your mortgage payments if rates rise.

- Stay informed: Keep an eye on economic indicators and announcements from the Bank of Canada to anticipate potential rate changes.

Changes in the Bank of Canada’s policy rate can impact your mortgage, influencing both your monthly payments and long-term financial planning. Whether you have a variable or fixed-rate mortgage, understanding these dynamics can help you make informed decisions and navigate the evolving economic landscape.

When is the next Bank of Canada interest rate announcement?

Staying up to date on the interest rate environment can help you make informed mortgage decisions – and prepare for any adjustments needed to stay on track with your homeownership and financial goals.

The next Bank of Canada interest rate announcement is Wednesday, September 17, 2025.

How Bank of Canada Rate Changes Impact Your Mortgage Affordability

The Bank of Canada’s policy rate is more than just a number — it’s a key factor that shapes your mortgage payments, housing affordability, and long-term financial planning. Whether you hold a fixed or variable-rate mortgage, rate changes can directly or indirectly influence your monthly budget and the timeline for paying off your home. By staying informed about policy announcements, preparing for potential rate shifts, and consulting with a trusted RBC Mortgage Specialist, you can make confident decisions that keep your mortgage working in your favor.