Types of Emergency Loans

Key takeaways

- Several emergency loan types, including personal loans and credit card advances, can fund urgent needs quickly — in some cases within one business day.

- Payday loans and title loans should be used as a last resort since they come with steep borrowing costs and may be difficult to repay.

- If you have a bad credit score, you may be ineligible for less-expensive options like personal loans.

Knowing what types of emergency loans are available is critical to getting you the funds you need as soon as possible when you’re faced with an emergency expense. Most emergency loan types can provide you with quick access to cash, and some have long repayment terms to keep your payments low.

You’ll need to do your research though — some emergency loan rates are as high as 600 percent with full payment required in two weeks. Learning about emergency loans in advance may help you avoid taking on unaffordable debt in a crisis.

1. Personal loans

Personal loans give you a lump sum of cash. They are repaid in fixed monthly installments, with terms typically ranging between one and seven years. A key benefit of a personal loan is being able to get your cash as soon as the day you apply, which comes in handy in an emergency.

You can get personal loans at banks, credit unions and through online lenders. Excellent credit personal loan APRs may be below 7 percent, making them a cheaper alternative than credit cards. Bad credit loan APRs, on the other hand, may be over 30 percent — a hefty cost if you can’t pay them off ahead of schedule.

Who personal loans are better for

Borrowers with good credit who need funds urgently, want lower interest rates than credit cards and prefer a fixed payoff schedule should consider a personal loan.

| Pros | Cons |

|---|---|

| Quick access to cash. | Steep interest rates if you have poor credit. |

| Typically doesn’t require collateral. | Loan origination fees are up to 12% of the loan amount in some cases. |

| Lower interest rates and longer terms than other forms of emergency financing. | Repayment options are shorter than home equity lending options. |

2. Credit card cash advances

Credit cards can be useful tools in an emergency when used responsibly. Many credit cards offer a cash advance feature that may allow you to access cash from an ATM or bank branch in a crunch. Since the cash advance is tied to your existing card’s credit limit, it doesn’t require an additional credit check.

While credit card cash advances may be a quick and easy funding choice, they typically have higher interest rates than your card’s standard variable APR. Plus, interest will also start to accrue right away on a cash advance, since there often isn’t a grace period.

Who credit card advances are better for

Those with active credit cards in good standing who need a quick small loan and who can afford the added fees and interest charges will be the best fit for this type of emergency cash.

| Pros | Cons |

|---|---|

| Funds are accessible from any ATM. | High rates and fees. |

| Cash advance option may already be set up on an existing credit card. | Borrowing amount is limited. |

| No additional credit check required for most advances. | Interest begins accruing immediately. |

3. Payday loans

A payday loan is a type of instant loan that lets you borrow up to about $500, usually without a credit check. Payday loans typically have to be repaid within two weeks or by your next pay period.

This kind of emergency loan is generally considered extremely risky because standard payday lender APRs are about 400 percent, according to the Consumer Financial Protection Bureau. And they can be even higher. The short repayment period combined with high fees often makes it hard for people to repay what’s owed by the due date.

Who payday loans are better for

Payday loans are the best fit for those with poor credit who can’t qualify for any other type of emergency loan and can pay the entire balance off before their next paycheck.

| Pros | Cons |

|---|---|

| Easy to qualify for, often without a credit check. | Extremely high APRs. |

| Fast funding. | Very short repayment period. |

4. Title loans

A title loan is another type of emergency loan that gets you fast access to cash secured by equity in your car. Also called a “pink slip loan,” this option allows you to borrow against 25 to 50 percent of the current market value of your vehicle.

Unlike some other emergency loan options, title loans are secured and require you to use your car for collateral. If you can’t repay the balance by the end of your loan term, the lender can seize your vehicle as repayment.

Who title loans are better for

Title loans may be the only option for borrowers with poor credit but who own a free and clear vehicle. They should be a last resort in a dire situation, especially since you risk losing a source of transportation if you can’t pay the loan back.

| Pros | Cons |

|---|---|

| Quick access to cash. | A lender can repossess your vehicle if you default on the loan. |

| Easy to qualify for. | Must own and have equity in a vehicle. |

5. Paycheck advances

Some employers offer paycheck advances, which allow you to receive upfront funds from your future earnings. Employers that offer this benefit may limit advance amounts and how often you can access them.

Third-party paycheck advance apps like Dave and Earnin also offer cash advances that you repay with your next paycheck. There is usually a fee for each advance. You may be charged a monthly subscription or maintenance fee to use the services.

Who paycheck advances are better for

Individuals who are paid on a regular schedule and need a small, short-term loan to cover an urgent financial need quickly would benefit most from these.

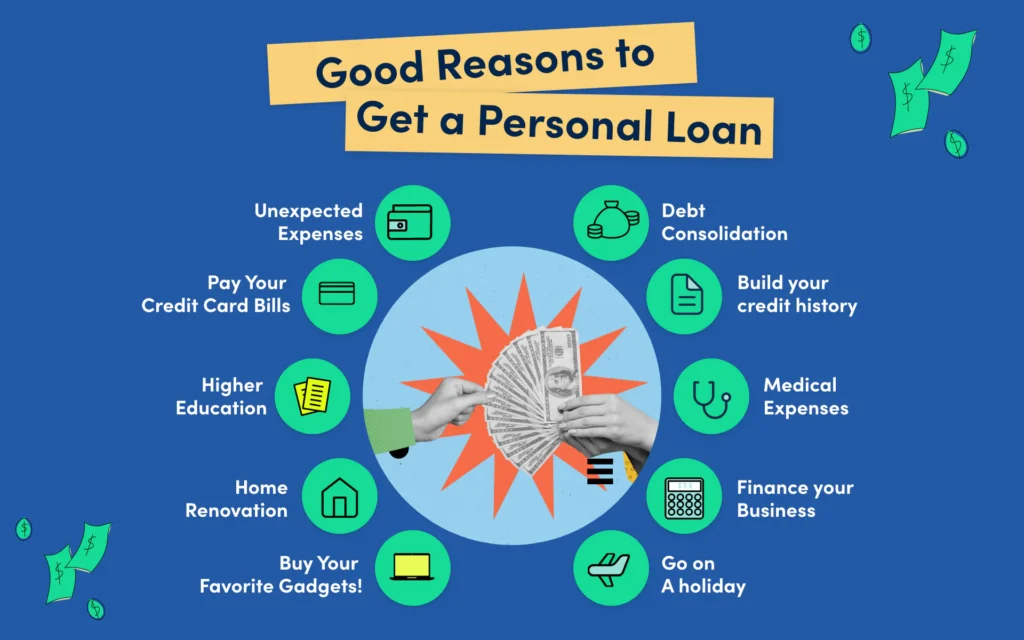

What can emergency loans be used for?

You can use an emergency loan for just about any unexpected expense you don’t have the cash to pay for. However, there are some urgent common scenarios that lead consumers to apply for an emergency loan.

- Car repairs. Significant repairs like an engine or bumper replacement can cost anywhere from a few hundred dollars to $10,000. Depending on your financial situation, an emergency loan might be the only path to getting your vehicle back on the road.

- Medical expenses. Even with health insurance coverage, the average U.S. employee paid $1,787 out of pocket in 2024 before hitting their deductible, according to recent data. If the provider doesn’t offer any payment plans and demands immediate repayment, an emergency loan can help you avoid collection actions.

- Home repairs. The average household spent $978 on emergency home repairs in 2024, according to Angi’s 2024 State of Home Spending Report. If something breaks down and you can’t afford to cover it out of pocket, an emergency loan can come in handy.

- Funeral costs. The sudden loss of a loved one may result in unexpected funeral costs. If an emergency loan is your only option to pay for a funeral, consider jointly applying for the loan with siblings or heirs, so the responsibility for the loan doesn’t fall only on you.

How to pick the right type of emergency loan

The right emergency loan for you depends on a number of factors, including how quickly you need the money and how much you need to borrow. If none of these fit, you may want to consider some alternatives to emergency loans before making your next move.

| Emergency loan type | Better for | A good fit for this type of emergency bill |

|---|---|---|

| Personal loan | Quick funding. Medium terms. Bad credit. | Home repairs that require up-front cash. Auto repairs that require immediate payment. Last-minute funeral expenses. |

| Credit card cash advance | Current credit card holders. Borrowers with significant available credit. | Medical deductibles or emergency dental work. Natural disaster that causes reduction in income. |

| Payday loans | Small urgent amounts. Borrowers that don’t qualify for personal loans. | Utility shut off or other essential needs. Emergency medical prescriptions not covered by insurance. |

| Title loans | Borrowers with a free and clear car. Car owners who want to avoid payday loans. | Cash needs beyond what payday loan limits allow. Small home repairs. |

FAQs

1. What is considered an emergency loan?

An emergency loan is any type of financing that provides quick access to funds for urgent expenses. Common examples include personal loans, credit card cash advances, payday loans, title loans, and paycheck advances.

2. How quickly can I get an emergency loan?

It depends on the type of loan. Personal loans and credit card advances can sometimes fund within the same business day. Payday and title loans may provide instant cash, but usually at much higher costs.

3. Which type of emergency loan has the lowest interest rates?

Personal loans typically offer the lowest interest rates, especially for borrowers with good credit. APRs for excellent credit may start below 7%, while payday and title loans often carry APRs of 200%–600%.

4. Are payday loans safe to use?

Payday loans are considered risky because they come with extremely high interest rates and very short repayment terms. They should only be used as a last resort when no other financing option is available.

5. Can I get an emergency loan with bad credit?

Yes, but options are limited. Payday loans, title loans, or certain online lenders may approve borrowers with poor credit, though at a much higher cost. Some credit unions and community lenders may also offer “bad credit” personal loans.

6. What can I use an emergency loan for?

Emergency loans can be used for unexpected expenses such as car repairs, home repairs, medical bills, funeral costs, or urgent utility payments. However, it’s best to borrow only what you truly need.

7. What happens if I can’t repay an emergency loan?

Failure to repay can result in serious consequences, including damage to your credit score, collection actions, wage garnishment, or loss of collateral (in the case of title loans).

8. Are there alternatives to emergency loans?

Yes. Alternatives include borrowing from family or friends, asking your employer for a paycheck advance, negotiating a payment plan with your service provider, or using a 0% APR credit card if available.

9. How do I choose the right emergency loan?

Consider your credit score, how much you need, how fast you need the money, and the total repayment cost. Compare APRs, fees, and repayment terms before committing.

10. How can I avoid needing emergency loans in the future?

Building an emergency savings fund of at least three to six months of expenses, maintaining good credit, and keeping debt levels manageable can help reduce reliance on emergency loans.

Conclusion

Most experts recommend saving three to six months of expenses to avoid needing to finance an emergency. To avoid paying extra interest on loans for emergency bills, do your best to stash extra cash to build up your savings.

Keeping your credit in tip-top shape can help you get the lowest rates at the best terms if you need a loan in an urgent situation.