Step-by-Step Guide to Investing in Savings Bonds

Find information on how to buy, redeem and manage your Savings Bonds here.

Product Information:

1. Overview

Savings Bonds are a special type of Singapore Government Securities (SGS) with features that make them suitable for individual investors. Savings Bonds are fully backed by the Singapore Government.

| Eligibility | Only individuals aged 18 years and above. |

|---|---|

| Issuer | Government of Singapore. |

| Term | Up to 10 years. |

| Interest rate | Rates are based on the average SGS yields the month before. Interest rates “step up” (increases) each year. Note: At issuance, interest rates for the entire 10-year term are fixed and locked in for each issue |

| Investment amount | Minimum per bond: S$500 Maximum individual holding: S$200,000 Note: Investment sum should be in multiples of $500. |

| Interest payments | Every 6 months after issuance.For cash investments, the interest will be automatically paid into the bank account that is linked to your individual CDP Securities account. For SRS investments, interest will be paid into your SRS account. |

| Issuance | A new Savings Bond will be issued every month according to the issuance calendar. |

| Allotment results | Announced on the 3rd last business day of the month. Successful applicants will be notified by the CDP by mail. For SRS investments, you will be notified by the SRS operator. For unsuccessful or partially filled applications, any excess money will be refunded by the end of the 2nd last business day of the month. |

| Maturity and redemption | Savings Bonds are redeemable in any given month, with no penalty for exiting the investment early. For both maturity and redemption, you will receive the principal amount by the second business day of the next month. Accrued interest on the redemption amount shall be paid. Note: Redemption amounts must be in multiples of S$500. |

| Tax | Exempt from tax. |

| Non-transferable | Savings Bonds cannot be transferred except in specific situations such as the death of the bondholder.They cannot be bought or sold in the open market, traded on the SGX, or pledged as collateral. Note: Upon the death of a bondholder, the Savings Bonds may be transferred to the rightful beneficiaries according to the person’s will or under the intestacy law. Such authorised transfers are not subject to the individual limit of S$200,000. |

2. Risks

Did you know that Savings Bonds are one of the safest instruments you can invest in?

Fully Backed by the Singapore Government

Your principal investment and interest payments are backed by the full faith and credit of the Singapore Government. The Singapore Government has received the strongest “AAA” credit rating from international credit rating agencies.

What Happens When Interest Rates Change?

The prices of conventional bonds can change, depending on current market interest rates. If you invest in conventional bonds, you may receive more or less than your invested capital if you sell them before they mature.

However, you will always get your principal back when investing in Savings Bonds. Once a Savings Bond is issued, interest rate changes will have no effect on the bond’s value.

Should market interest rates rise, there is no price loss on your Savings Bond as you can get your full principal value back if you decide to redeem the bonds with the Government. Should interest rates fall, you will not enjoy any price gains. However, you would benefit from the above-market interest rates on your

3. Returns and Interest

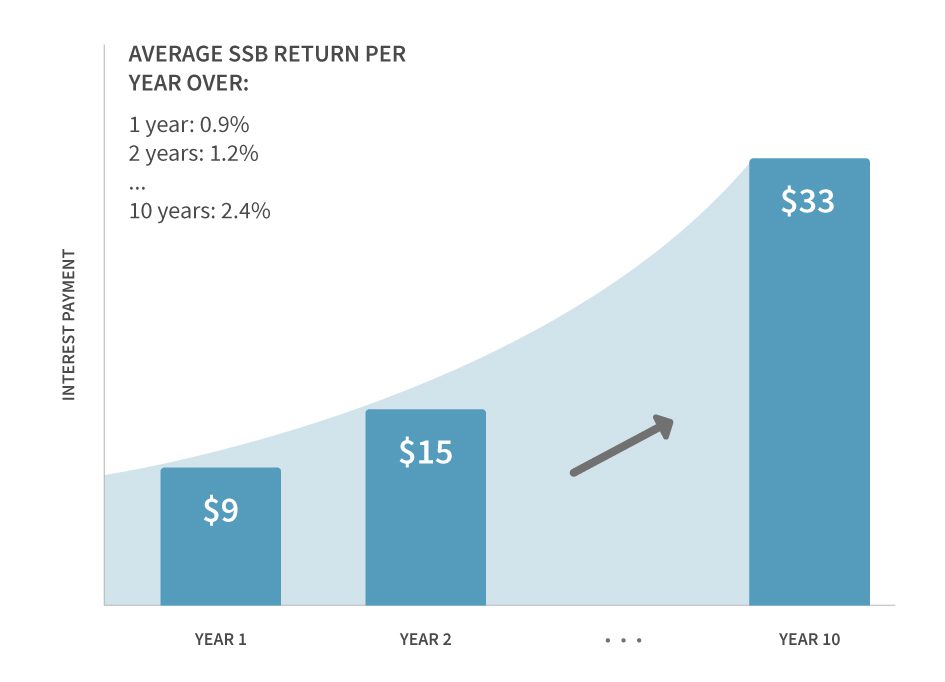

Savings Bonds offer you a return that corresponds with how long you hold them for. You receive less interest at the start, but the amount “steps up” or increases over time. The longer you hold your Savings Bonds, the higher your effective return.

At the beginning of each month, MAS will announce the interest rates for the entire 10-year term of that Savings Bond issue. These interest rates will be locked-in when you subscribe. Tip: To keep track of all your Savings Bond interest payments, log in to the My Savings Bond portal.

Based on Government Bond Returns

The interest rates of each Savings Bond issue are based on the average Singapore Government Securities (SGS) yields the month before applications for that issue open, and may be adjusted to maintain the “step-up” feature if market conditions do not allow it.

If you hold your Savings Bond for the full 10 years, your return will match the average 10-year SGS yield the month before your investment. In the last 10 years, the 10-year SGS yield has been between 2% to 3% most of the time.

If you decide to redeem your Savings Bond early, you will receive a lower return. You will receive pro-rated, or accrued interest. In general, an investor who holds a Savings Bond for a given number of years would receive an average return similar to that of an SGS of the same tenor.

How to Buy:

1. Key details

| Who can apply | Individuals, including non-residents. You need to be at least 18 years old to open a CDP account. |

|---|---|

| Ways to apply | For cash – DBS/POSB, OCBC or UOB ATMs or internet banking, and OCBC’s mobile application.For Supplementary Retirement Scheme (SRS) – internet banking portal of your SRS operator. Note: CPF funds are not eligible for Savings Bond purchases. |

| Investment amount | Minimum of $500, and subsequent multiples of $500.Maximum individual investment limit: $200,000. |

| Frequency of issuance | A new bond is issued every month. Check out this month’s bond or view the issuance calendar for the year. |

| Application period | Opens at 6pm on the 1st business day of the month. Closes at 9pm on the 4th last business day of the month. Operating hours: 7am to 9pm, Monday to Saturday (excluding Public Holidays). |

| Fees | $2 non-refundable transaction fee for each application. |

2. Steps to Your First Savings Bond

1. For Cash Applications

You will need:

- A bank account with DBS/POSB, OCBC and UOB. Open a bank account online or visit any of the banks’ branches in Singapore to open an account.

- An individual CDP Securities account with Direct Crediting Service activated. This allows interest payments from your Savings Bonds to be credited directly into your bank account.

CDP is the custodian for Savings Bonds bought with cash. It will process applications, interest payments and redemptions.

For SRS Applications

You will need an SRS account. If you don’t already have an SRS account, visit one of the three SRS operators (DBS/POSB, OCBC and UOB) to open an SRS account.

Your SRS operator is the custodian for Savings Bonds bought with SRS funds.

3. Via ATMs or Internet Banking Portals

A new Savings Bond is issued on the 1st business day of each month. You can apply using either cash or SRS funds.

Cash Applications: Via ATMs or Internet Banking Portals

Apply through DBS/POSB, OCBC and UOB internet banking or ATMs, and OCBC’s mobile application. Please have your CDP account number with you when you apply.

Money will be deducted from the bank account tied to your ATM card or selected internet banking account at the point of application.

A non-refundable $2 transaction fee will be charged by the bank for each application request.

SRS Applications: Via Internet Banking Portals

Apply through the internet banking portal of your SRS operator. SRS funds will be locked, or earmarked, when you apply.

A non-refundable $2 transaction fee will be charged by the bank for each application request.

Note:

- You cannot apply for Savings Bonds in person at the bank counters.

- Once submitted, application requests cannot be amended or cancelled.

4. Check the reults

MAS will allot the new Savings Bond among applicants on the 3rd last business day of the month (called the “Allotment Day”). The application results will be available on our website after 3pm on Allotment Day. Savings Bonds will be issued on the 1st business day of the following month.

If you invested using cash, you will be notified by CDP via mail of the amount of Savings Bonds allotted to you. You can also check your holdings online through the CDP internet service or by calling CDP at 6535-7511.

If you invested using SRS funds, you will be notified by your SRS operator via mail of the amount of Savings Bonds allotted to you. You can also check your holdings of Savings Bonds with your SRS operator.

Alternatively, you can log in to the My Savings Bonds portal to check and keep track of all your Savings Bonds holdings.

Refunds for Partially Filled Applications

Should the total amount of applications exceed the amount on offer in a particular month, you may not get the full amount you applied for (why not?).

The excess cash will be refunded to you by the end of the 2nd last business day of the month.

You can check the amount refunded in the bank account you used for the application.

Note: The $2 transaction fee charged by the bank is not refundable.

4. Receive the first interest payment

You will receive the first interest payment 6 months after the bond is issued. Interest will be automatically paid into:

- The bank account that is linked to your CDP account (cash applications).

- Your SRS account (SRS applications).

Interest will be paid every 6 months after that, on the 1st business day of the month. The interest payments will be reflected in:

SRS statements (SRS applications).

Your CDP statements (cash applications).

How to Redeem:

When Your Bond Matures

Each Savings Bond has a term of 10 years. At the end of 10 years, your principal and the last interest payment will be automatically credited to the bank account linked to your CDP account (for cash applications), or to your SRS account (for SRS applications).

You do not need to take any action, and the $2 transaction fee does not apply.

Redeeming Early

You can redeem your Savings Bonds in any given month before the bond matures, with no penalty for exiting your investmentearly.

To redeem, submit your request by the closing date through the following channels:

- Cash investments – DBS/POSB , OCBC and UOB internet banking or ATMs, and OCBC’s mobile application.

- SRS investments – Redemption requests for Savings Bonds purchased with SRS funds can only be made online through your SRS Operator.

Key details

| Redemption period | Opens at 6pm on the 1st business day of the month. Closes at 9pm on the 4th last business day of the month. Operating hours: 7am to 9pm, Monday to Saturday (excluding Public Holidays). |

|---|---|

| Redemption amount | Redeem in multiples of $500 up to the amount you have invested for each bond. You can redeem more than one bond per month. |

| Fees | $2 transaction fee by the bank for each redemption request. |

Please note that you will not be able to amend or cancel submitted redemption requests.

After You Submit Your Request

You will receive the amount you requested in full, along with any accrued interest, by the 2nd business day of the following month.

- For cash investments, the money will be credited as a single amount to the designated bank accountthat is linked to your individual CDP Securities account.

- For SRS investments, the money will be credited to your SRS account.

How Much Interest Will You Receive?

Savings Bonds pay interest every 6 months. If you redeem your bond when there is a scheduled interest payment, you will receive the scheduled interest together with your redemption amount.

If you redeem before the scheduled interest is paid, you will receive a pro-rated amount, called the accrued interest, which is the interest you have earned but have not been paid.

Allotment for Oversubscribed Issues:

In a situation where total applications exceed the total issuance size, Savings Bonds are allocated according to the “Quantity Ceiling” format.

Quantity Ceiling

Each applicant will receive at least $500 of Savings Bonds. The amount will increase in multiples of $500 for every applicant until either an applicant has received the full amount applied for, or until all the available bonds have been allotted, whichever comes first.

If the number of applicants is so large that issuing $500 per applicant will exceed the amount of bonds available, the bonds will be allocated among applicants randomly, with each receiving $500 worth.

This means that you may not get the full amount you applied for. Smaller applications will also have a higher chance of being fully allotted.

Tip: With the quantity ceiling format, applying for a larger amount does not mean you will get more bonds. You should apply only for the amount you wish to buy.

Cutoff Amount

The cutoff amount is an important number to look out for when MAS announces the application result of each Savings Bond.

If your application is:

- Equal to or less than the cutoff amount, you will get the full amount you applied for.

- Above the cutoff amount, you will get either the cutoff amount or $500 more than the cutoff amount. The additional $500 is randomly distributed.

Wrapping Up: Benefits and Flexibility of Singapore Savings Bonds

In conclusion, Singapore Savings Bonds (SSB) are a low-risk, high-flexibilityinvestmentbacked by the Singapore Government. They are uniquely designed to offer the “step-up” interest of a long-term bond with the liquidity of a savings account, allowing you to withdraw your full principal and earned interest in any month without penalty. Whether used for short-term capital preservation or a 10-year retirement strategy, SSBs provide a secure, tax-free way to grow your savings with absolute peace of mind.