Personal Loan vs Home Loan: Best Guide by GlobalFinMate

Loans have become an integral part of modern financial planning. From buying a dream home to covering urgent medical expenses, borrowing money often helps bridge the gap between aspirations and affordability. Among the many types of loans available, personal loans and home loans are the most popular.

Both loans provide financial support, but they differ significantly in purpose, structure, interest rates, and repayment terms. A personal loan is flexible and unsecured, while a home loan is property-specific and secured against collateral.

If you’ve been wondering which option works best for you, this detailed blog will help you understand the differences between personal loan vs home loan, along with their advantages, drawbacks, eligibility, and tax benefits.

What is a Personal Loan?

A personal loan is an unsecured form of credit, which means you don’t need to pledge any asset or property to borrow. Lenders assess your creditworthiness, income, and repayment history to determine your eligibility.

Features of a Personal Loan

- No collateral required.

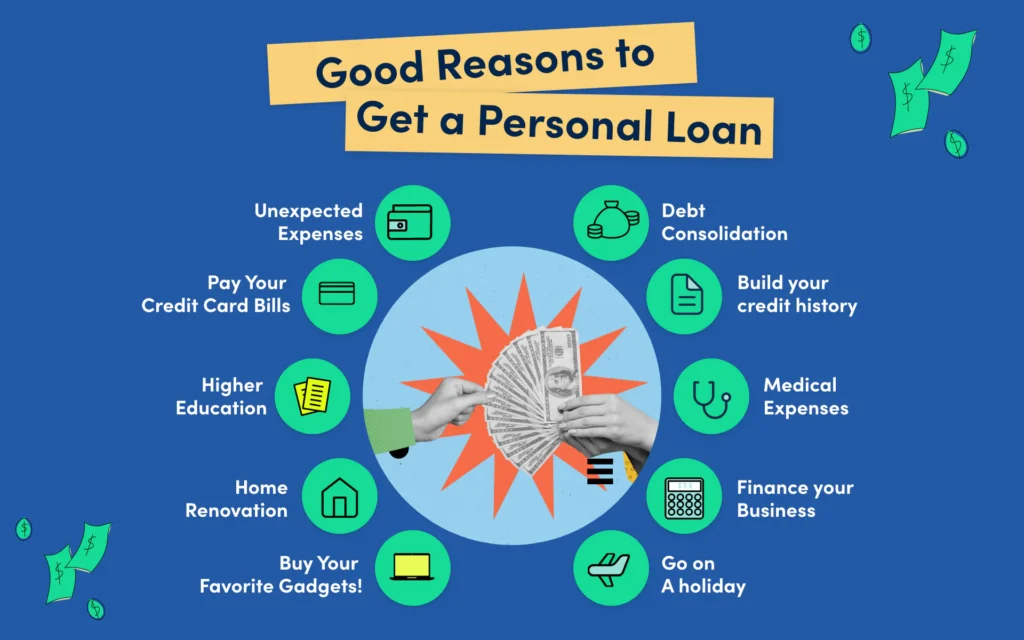

- Can be used for multiple purposes like weddings, education, travel, or emergencies.

- Loan amount depends on your income and credit score.

- Tenure is short, usually between 1–7 years.

- Higher interest rates compared to secured loans.

- Quick approval and disbursal, often within 24–48 hours.

What is a Home Loan?

A home loan is a secured loan that helps you purchase, construct, or renovate residential property. Since the loan is backed by the property itself, lenders offer larger amounts at lower interest rates.

Features of a Home Loan

- Property serves as collateral.

- Funds can only be used for housing-related purposes.

- Loan amount is higher and depends on the property’s value.

- Lower interest rates compared to personal loans.

- Longer repayment tenure (10–30 years).

- Lengthier approval process due to property checks and documentation.

Personal Loan vs Home Loan: A Quick Comparison

| Feature | Personal Loan | Home Loan |

|---|---|---|

| Type | Unsecured | Secured |

| Collateral | Not required | Required (property) |

| Purpose | Flexible – medical, travel, wedding, education, etc. | Housing – purchase, construction, renovation |

| Loan Amount | Lower (based on income & credit score) | Higher (linked to property value) |

| Interest Rate | 10%–24% approx. | 6%–12% approx. |

| Tenure | 1–7 years | 10–30 years |

| Approval | Quick (1–3 days) | Slower (1–4 weeks) |

| Tax Benefits | Limited or none | Yes (principal & interest deductions) |

Pros and Cons of Personal Loans

Advantages

- No collateral required.

- Quick processing and disbursal.

- Flexible usage of funds.

- Shorter repayment period helps close debt faster.

Disadvantages

- Higher interest rates increase borrowing cost.

- Lower loan amounts may not cover large expenses.

- Short tenure means higher EMIs.

- Strong dependency on credit score.

Pros and Cons of Home Loans

Advantages

- Lower interest rates make borrowing affordable.

- Higher loan amounts suitable for big investments.

- Long repayment tenure reduces EMI pressure.

- Tax benefits under Sections 80C and 24(b).

- Builds an asset that appreciates over time.

Disadvantages

- Property is mortgaged until repayment.

- Longer and more complex approval process.

- Long-term debt spanning decades.

- Risk of foreclosure if repayments are missed.

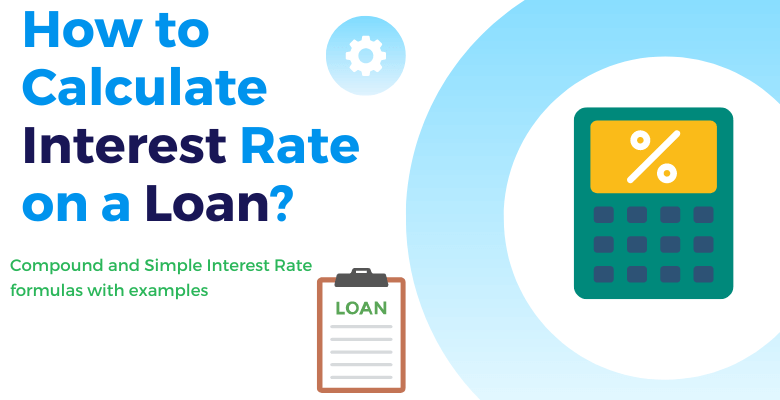

Interest Rates: Why the Difference?

Interest rates differ mainly because of risk. Personal loans are unsecured, which means lenders face higher risk and therefore charge higher interest (10%–24%). Home loans are secured against property, so lenders are protected and can offer lower rates (6%–12%).

Loan Tenure: Short vs Long

- Personal Loan: 1–7 years. Short-term commitment but higher EMI burden.

- Home Loan: 10–30 years. Long-term commitment but smaller EMIs.

Eligibility Criteria for Loan:

Personal Loan Eligibility

- Stable monthly income.

- Good credit score (650+).

- Age: 21–60 years.

- Proof of employment or business.

Home Loan Eligibility

- Adequate income to repay large EMIs.

- Strong credit score.

- Clear property ownership documents.

- Age: 21–65 years.

- Co-applicant option available to increase eligibility.

Tax Benefits

Personal Loan: Usually no tax benefits unless the loan is for property renovation, education, or business investment.

Home Loan: Offers significant tax savings:

- Section 80C: Deduction up to ₹1.5 lakh on principal repayment.

- Section 24(b): Deduction up to ₹2 lakh on interest repayment.

- Additional deductions for affordable housing schemes.

When to Choose a Personal Loan

A personal loan works best if:

- You need funds urgently (medical emergencies, weddings, travel).

- You don’t want to pledge collateral.

- Your requirement is small to medium.

- You prefer short-term borrowing with quick approval.

When to Choose a Home Loan

A home loan is ideal if:

- You’re buying, building, or renovating property.

- You need a large loan amount.

- You want lower interest rates and long tenure.

- You want to benefit from tax deductions.

- You’re financially stable for long-term EMIs.

Risks to Consider

- Personal Loan Risks: Higher EMI burden, negative impact on credit score if you default.

- Home Loan Risks: Foreclosure risk, long-term liability, and complications if property documents are unclear.

Smart Borrowing Tips for Loans:

- Borrow only what you can comfortably repay.

- Compare offers from multiple lenders.

- Maintain a healthy credit score.

- Watch out for hidden charges.

- Ensure EMIs fit within your monthly budget.

- Use prepayment options when possible to reduce interest burden.

FAQs

1. Can I use a personal loan to pay for the down payment of a home loan?

Yes, you can. Since personal loans offer flexible usage, many borrowers use them to cover the 10%–20% down payment required for a home purchase. However, remember that this increases your total monthly EMI burden, as you will be repaying two loans simultaneously.

2. Which loan is processed faster if I need money urgently?

A Personal Loan is much faster. It can be approved and disbursed within 24–48 hours because it is unsecured and requires minimal documentation. In contrast, a home loan can take 1–4 weeks due to mandatory property legal checks and technical valuations.

3. Why are interest rates for home loans lower than personal loans?

Interest rates are lower for home loans because they are secured loans. The property acts as collateral, which reduces the risk for the lender. Personal loans are unsecured, meaning the lender takes a higher risk and charges a higher interest rate (typically 10%–24%) to compensate.

4. Are there any tax benefits available for personal loans?

Generally, personal loans do not offer tax benefits. However, if you can prove that the loan amount was used for home renovation, business investment, or higher education, you may be eligible for specific deductions. Home loans, on the other hand, offer clear and significant tax savings under Sections 80C and 24(b).

5. Is it better to take a personal loan for a small home renovation?

It depends on the scale. For minor repairs or quick upgrades (like painting or new furniture), a personal loan is better due to its quick disbursal and lack of collateral. For major structural renovations, a home loan (specifically a home improvement loan) is better because of the lower interest rate and longer repayment tenure.

6. What happens if I am unable to repay my home loan vs. my personal loan?

If you default on a home loan, the lender has the legal right to seize and auction the mortgaged property to recover the debt. If you default on a personal loan, there is no collateral to seize, but your credit score will be severely damaged, and the lender may initiate legal action to recover the funds

Conclusion

Both personal loans and home loans serve different purposes and cater to different financial needs.

- A personal loan is best for short-term, urgent requirements without collateral but comes with higher interest rates and shorter tenure.

- A home loan is designed for long-term property investment, offering larger amounts, lower interest rates, tax benefits, and asset creation.

Ultimately, the right choice depends on your goals, repayment ability, and financial stability. By evaluating your needs carefully, you can pick the loan that helps you achieve your objectives without straining your finances.