Credit Card Vs Debit Card

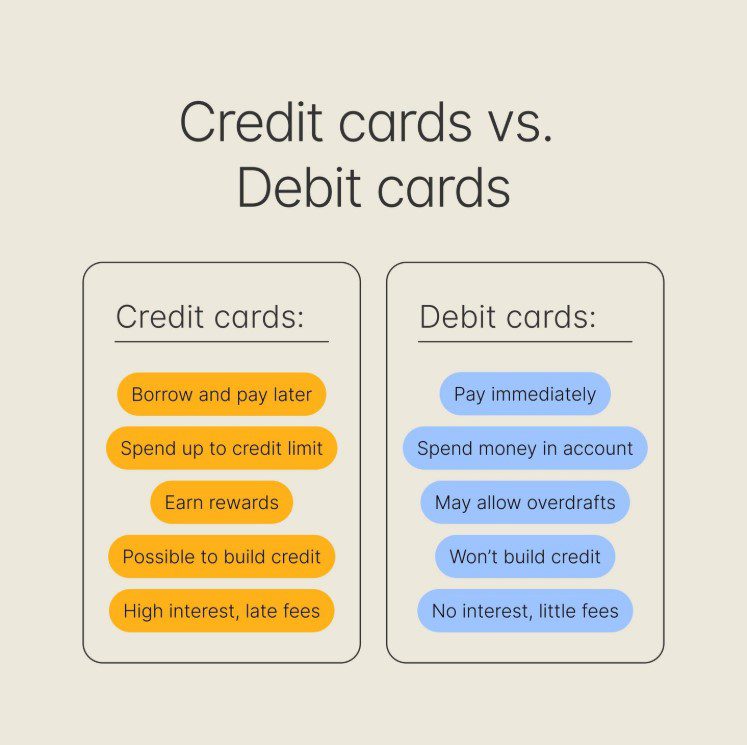

Credit Card Vs Debit Card look almost identical, but they are extremely different financial products.

Debit cards are linked to your own money, usually from your everyday or savings account. When you use a debit card to buy something, you pay for it upfront and have nothing to owe.

Credit cards are linked to a pre-approved credit limit extended to you by a bank or financial institution. When you use a credit card to make a purchase, you’re borrowing money and taking on short-term debt. To avoid interest charges, you’ll need to repay the balance within the statement period.

Put simply: a debit card lets you spend your money, and a credit card is a short-term loan that you must repay.

Credit cards – revolving credit and debt

A credit card allows you to borrow up to a certain limit based on factors like your income, expenses, and credit history. If it’s your first card, your limit may be relatively low — for example, $1,000 to $2,000.

This amount is not cash in hand, but a credit line that you can use, repay, and reuse. This is called revolving credit. As long as you make minimum payments and any required fees, the account remains active.

People often use credit cards for large or unexpected expenses — travel, electronics, or emergencies. But you should only charge what you can afford to repay in full to avoid interest charges. When used responsibly, credit cards offer flexibility and financial convenience.

How a credit card works

You use your card to make purchases up to your approved credit limit.

At the end of each billing cycle, you receive a statement listing your transactions, total balance, minimum due, and due date.

You can pay the full amount to avoid interest or pay at least the minimum amount required.

Debit cards – your cash

A debit card allows you to make purchases directly from your bank account. It uses your own money, not borrowed funds.

You need to ensure that your account has enough balance before spending. Since there’s no debt involved, you don’t owe anything after a purchase — but you still need to track your expenses.

How a debit card works

You spend money directly from your bank account.

There’s no interest involved since you’re not borrowing.

You receive monthly statements mainly for transaction tracking.

The major differences between credit and debit

You don’t need to choose just one. Most people use both credit and debit cards, depending on the situation.

Access to cash

You can withdraw money from an ATM using your debit card since it’s your money. Credit cards, on the other hand, allow cash advances — withdrawing money on credit. However, this usually comes with higher fees and interest rates.

In emergencies, a credit card can be useful if you don’t have enough in your account or savings. Debit cards won’t allow you to spend more than you have.

Annual fees

Credit cards often come with annual or monthly fees, though some offer no-fee options. Fee structures vary depending on the card issuer and features.

Debit cards, typically linked to everyday accounts, often have lower or no fees. Some accounts may waive fees based on monthly deposits or account activity. It’s worth comparing options to minimize unnecessary charges.

Building credit

Paying bills like rent or utilities on time is good for your financial track record, regardless of the payment method.

However, credit cards directly impact your credit score because they involve borrowing. Making regular, timely payments builds creditworthiness. Missed or late payments can hurt your score.

Eligibility

Getting a debit card usually requires only a valid identity and a bank account. Credit card applications, however, involve eligibility checks including income verification and credit history.

Insurances and rewards

Credit cards often offer additional perks such as travel insurance, extended warranties, and reward programs. These points can be redeemed for things like travel, merchandise, or discounts.

Debit cards usually don’t offer reward points, though some banks may provide access to special offers or discounts.

Liability and fraud protection

Most credit and debit cards today offer solid fraud protection features like EMV chips, PINs, and CVV codes.

The main difference is financial liability. If your debit card is compromised, your actual funds are at risk, and it may take time to recover the amount. With a credit card, it’s the bank’s money at risk, and you usually won’t be held liable for unauthorized transactions.

Spending limits

Credit cards come with a set spending limit. If you want to increase this limit, you’ll need to make a request and meet the issuer’s criteria.

Debit cards have limits too, mostly for daily withdrawals and purchases, as a security measure — but you’re limited by the actual balance in your account.

When to use a credit card vs debit card

Both types of cards can complement each other. Choose based on your financial goals.

A credit card can help build your credit score, provide emergency access to funds, and offer rewards — but only if you can manage repayments on time.

A debit card is ideal if you want to avoid debt, live within your means, or are still developing responsible money habits.

Use what suits your financial situation best. You can always re-evaluate your choices later. The goal is long-term financial stability and freedom — and there are many paths to get there.

Frequently asked questions

Is a Visa debit card a credit card?

No. Visa debit cards are linked to your bank account and use your funds to complete purchases. While they use the Visa payment network (like some credit cards), they do not involve borrowing.

Is Mastercard a credit card?

No. Mastercard is a payment processing network used by both debit and credit cards. The card type depends on the product — not the network.