How to aplly First Credit Card

Just a decade ago, credit cardswere considered a luxury in many parts of the world, often limited to a select few with strong financial backgrounds. But things have changed dramatically. Credit cards are now a common financial tool, providing users with flexibility, convenience, and the opportunity to build a solid credit history.

If you’re thinking about applying for your first credit card, this guide will walk you through everything you need to know — from eligibility to responsible usage.

Understanding the Basics of Credit Cards

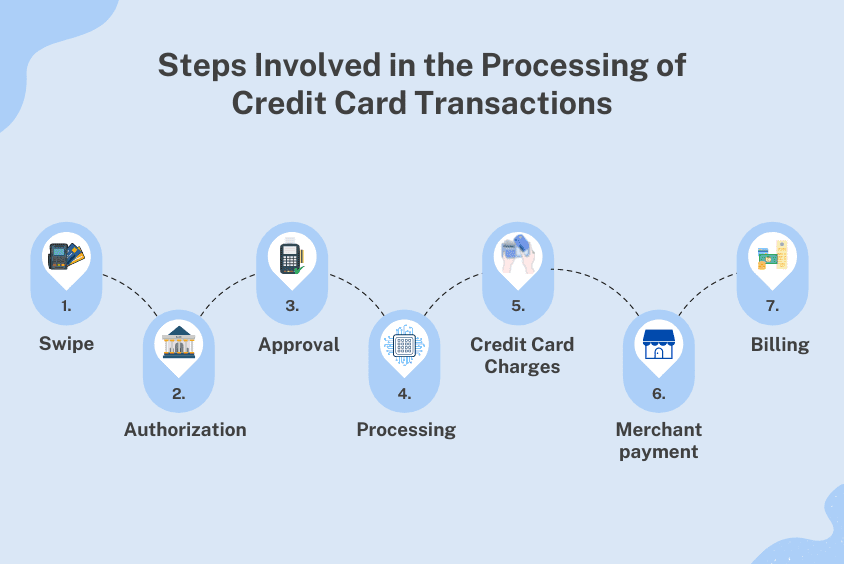

A credit card is a payment tool issued by a bank or financial institution that gives you access to a set credit limit. You can use it to make purchases or pay for services, and you’re expected to repay the amount within a billing cycle.

Unlike loans that provide a lump sum upfront, credit cards let you borrow as you spend, up to your approved limit. For example, if your card has a credit limit of $2,000 and you make a purchase worth $800, you’re expected to repay that amount by the due date to avoid interest. If you don’t pay the full balance, interest will apply to the remaining amount.

Each month, you’ll receive a statement listing your spending, the total amount due, and the minimum payment required. Timely repayment helps avoid interest charges and builds your credit score.

Checking Your Eligibility: Before applying, it’s important to ensure you meet the basic criteria typically required by most banks or financial institutions:

- Age: You usually need to be at least 18 years old to apply.

- Income: A steady income is generally required, with minimum income thresholds varying depending on the card and issuer.

- Credit History: If you have no credit history, you may still be eligible for entry-level or secured credit cards. A credit score in the “good” range or above improves approval chances.

- Residency: Most issuers require proof of residence in the country where the application is being made.

Choosing the Right Credit Card: There are various credit cards designed to meet different needs. As a first-time applicant, choose a card that fits your lifestyle and financial habits:

- Fees: Look for cards with no or low annual fees. Some cards are free for life and are ideal for beginners.

- Rewards: Choose a card that offers benefits like cashback, travel points, or shopping rewards in categories where you spend the most.

- Eligibility: Pick a card where you meet the basic income and residency requirements.

- Issuer Reputation: Opt for banks or issuers known for good customer service and secure technology.

Preparing the Required Documents: To apply, you’ll need to submit personal and financial documents, which may include:

- Proof of Identity: Passport, national ID card, or driver’s license.

- Proof of Address: Utility bill, lease agreement, or government correspondence.

- Proof of Income: Salary slips, bank statements, or tax returns.

- Photograph: Some issuers may require a recent photo.

Applying for Your First Credit Card: Once you’ve chosen a suitable card and gathered your documents, follow these general steps:

- Visit the card issuer’s website or local branch.

- Fill out the application form with accurate personal, financial, and employment details.

- Submit your documents along with the completed form.

- The issuer will verify your information and assess your application.

- If approved, your card will be mailed to you within a few business days.

- Activate your card online, through a mobile app, or by calling customer service.

- Set a secure PIN and sign the back of your card before using it.

Using Your Credit Card Responsibly: Proper usage is key to maintaining financial health and building a positive credit history. Follow these practices:

- Create a monthly budget and spend only what you can afford to repay.

- Pay your bill on time to avoid interest charges and late fees.

- Pay in full when possible to avoid accumulating debt. If not, pay more than the minimum due.

- Review your statements regularly for any unauthorized or incorrect charges.

- Avoid cash advances as they usually come with higher interest rates and fees.

- Keep your balance low by using less than 30% of your credit limit at any time.

Building a Good Credit Score: A well-managed credit card can help you build and maintain a strong credit score. Here’s how:

- Always pay on time.

- Keep your credit usage low.

- Limit the number of new credit applications.

- Monitor your credit report regularly to ensure it’s accurate.

Pros and Cons of Using Credit Cards

Pros:

- Helps with large purchases and flexible repayment

- Safer and more convenient than carrying cash

- Builds a credit history and improves credit score with responsible use

- Offers rewards, cashback, and exclusive benefits

Cons:

- Risk of accumulating debt if not used wisely

- Can encourage unnecessary or impulsive spending

- Missed payments hurt your credit score

- Carrying a balance leads to interest charges

Conclusion: Getting your first credit card is an important financial step. When chosen and used wisely, it can help you build credit, manage expenses more efficiently, and enjoy added security and benefits.

Focus on finding the right card, using it responsibly, and staying disciplined with your repayments. These habits will help you establish a solid financial foundation and unlock greater financial opportunities in the future.This update applies to U.S. residents and is based on the latest data released by U.S. federal agencies.